The Surprising Reality of Massachusetts Home Price Growth in 2025

Freddie Mac: Mortgage Rates Hit 3-Year Low | Trump's $200 Billion Bonds Bet | Zillow: More Affordability in 2026 | Boston: A "Hot" Market in 2026?

Slower Price Growth May Improve Housing Affordability in 2026, But Don't Expect Prices to Decline

For prospective Massachusetts home buyers hoping 2025 would bring lower home prices, last year brought more bad news.

Massachusetts real estate prices rose in 2025, but – the good news – more slowly than in the previous four years, and sales increased modestly. Tight inventory likely means a similar 2026, but lower interest rates will improve affordability for some home buyers.

Of course, local markets vary widely in terms of sales, prices, and inventory.

Massachusetts Single-Family Homes (2025 vs. 2024)

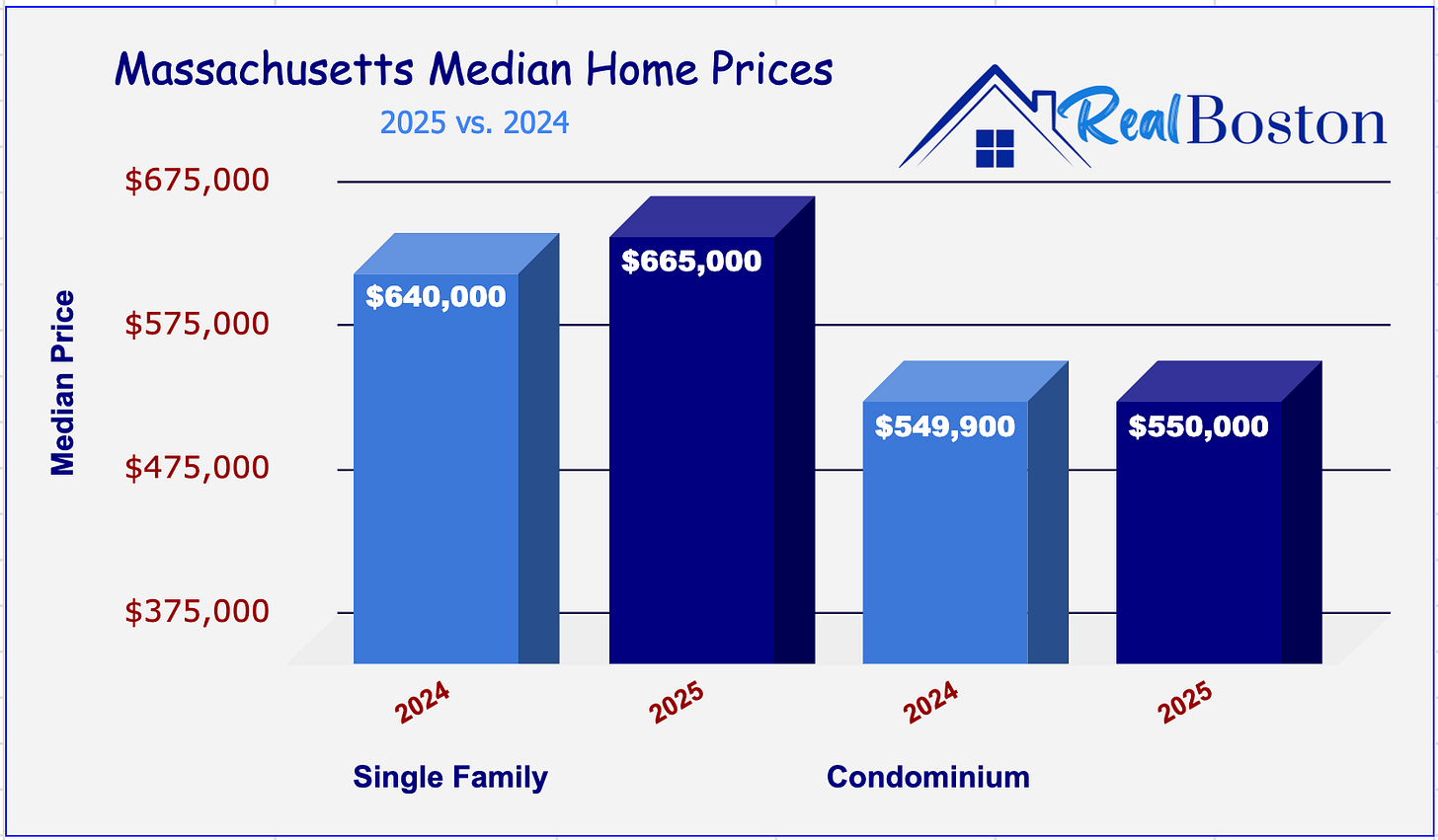

The median price of a single-family home in Massachusetts increased 4 percent in 2025 to $665,000 from $640,000 in 2024, according to data compiled by the Massachusetts Association of Realtors (MAR).

Median house prices rose 7 percent in 2024, 5 percent in 2023, nearly 9 percent in 2022, and 15 percent in 2021.

Since 2020, when the median price was $460,000, single-family home prices in Massachusetts have risen by almost 45 percent.

Single-family home sales rose modestly in 2025, increasing less than 2 percent to 40,465. The number of houses sold in Massachusetts was 30 percent fewer than the 58,071 sold in 2020.

Massachusetts Single-Family Homes (December 2025)

The number of closed sales in Massachusetts in December 2025 grew by only 33 houses, or 1 percent, to 3,528. Home buyers purchased nearly 6,000 single-family homes in December 2020.

The median house price increased about 2 percent in 2025, from $626,000 in December 2024 to $641,000.

The number of available single-family homes in December dropped by almost 14 percent, and the months of supply declined to about five or six weeks. MAR calculates the months of supply by dividing the inventory of homes for sale at the end of any given month by the average monthly pending sales over the past 12 months.

New listings in December grew by only 11 houses, or less than 1 percent, from 1,593 in December 2024.

Massachusetts Condominiums (2025 vs. 2024)

The median price of a Massachusetts condominium increased by only $100 in 2025 to $550,000 from $549,900 in 2024, according to MAR.

Median condo prices rose 4 percent in 2024, 6 percent in 2023, almost 7 percent in 2022, and 12 percent in 2021.

Since 2020, when the median price was $419,400, condominium prices in Massachusetts have risen by 31 percent.

Condominium sales rose slightly in 2025, increasing 2 percent to 17,296. The number of condos sold in Massachusetts was nearly 33 percent fewer than the 25,642 sold in 2021. Home buyers purchased 21,665 condominiums in 2020.

Massachusetts Condominiums (December 2025)

The number of closed condo sales in Massachusetts in December 2025 grew by 42 units, or 3 percent, to 1,444. Home buyers purchased 2,228 condominiums in December 2020.

The median condo price decreased about 3 percent in 2025, from $539,450 in December 2024 to $525,000.

The number of available condominiums in December decreased 4 percent, and the months of supply declined to about seven weeks.

New listings in December grew nearly 8 percent to 841 units, from 782 in December 2024.

Mortgage Rates Start 2026 Lower

The average interest rate for a mortgage loan in the United States declined to a multi-year low for the week ending January 15, 2026, according to Freddie Mac’s weekly Primary Mortgage Market Survey.

The 30-year, fixed-rate mortgage loan averaged 6.06 percent, down from 6.16 percent the prior week and 7.04 percent a year ago.

“Late last week, mortgage rates dropped, driving the weekly average down to its lowest level in more than three years,” said Sam Khater, Freddie Mac’s Chief Economist. “The impacts are noticeable, as weekly purchase applications and refinance activity have jumped, underscoring the benefits for both buyers and current owners. It’s clear that housing activity is improving and poised for a solid spring sales season.”

In Massachusetts, loan officers are quoting rates below 6 percent. One experienced loan officer told Real Boston that strong borrowers, e.g., high credit scores, low debt-to-income ratios, and significant savings, might qualify for a 30-year, fixed-rate mortgage at 5.75 percent.

The 15-year, fixed-rate mortgage, a popular choice for homeowners who want to refinance, averaged 5.38 percent. The 15-year note averaged 5.46 percent the prior week and 6.27 percent one year ago.

President Wants Federal Government to Purchase $200 Billion in Mortgage Bonds

In an effort to reduce mortgage rates and monthly payments for homebuyers, President Donald J. Trump directed unnamed “representatives” to purchase $200 billion in mortgage bonds last week.

While Trump did not specify which agencies should make the bond purchases, he suggested that Fannie Mae and Freddie Mac have significant cash reserves available for this purpose.

The purchase of $200 billion in mortgage bonds could slightly lower mortgage interest rates, but the impact is likely limited. Inflation rates, unemployment numbers, and the overall strength of the economy drive interest rates.

Home-buying consumers waiting for rates to decrease could backfire, as small dips often spur more competition and higher home prices. First-time home buyers should focus on payment comfort and financial readiness rather than chasing rate headlines.

Zillow Research Indicates Homes Will Be More Affordable in 2026

Online real estate portal Zillow predicts housing affordability will improve in 2026, driven by slower price growth, falling mortgage rates, and rising incomes.

Zillow forecasts that 20 of the 50 largest U.S. metro areas will be affordable to buy in by the end of 2026 — the most since 2022.

Zillow defines affordability as a mortgage payment on a typical-priced house that does not exceed 30 percent of the median household income. When housing costs rise above 30 percent, they become a financial burden, leaving less in the budget for other essentials, such as groceries and transportation.

In the Boston metro area, according to Zillow, affordability will improve, but housing costs will far exceed 30 percent of median household income. In 2025, Metro Boston’s household mortgage share stood at 44 percent, but Zillow expects it to decline to 42.9 percent.

Zillow Predicts a ‘Hot’ Real Estate Market for Boston in 2026, But Hotter Markets in Hartford and Providence

Boston has cracked the top 10 in Zillow’s recently released forecast of the Hottest Housing Markets for 2026, jumping from No. 16 last year to No. 7. While nice properties priced right attract competition, two neighbors in Southern New England are hotter markets according to Zillow.

#1 Hartford, CT: Dethroned Buffalo to take the top spot nationally. It faces a massive inventory shortage (63 percent below pre-pandemic levels), leading to 66 percent of homes selling above asking price.

#4 Providence, RI: Though it slipped slightly from its No. 3 spot last year, Providence remains a “hotter” market than Boston due to faster home value growth (2.5 percent vs. Boston’s 1.2 percent).

#7 Boston, MA: Zillow reports that 65 percent of Boston homes sold over asking price in 2025.

Real Boston reported in October that the condominium market in the City of Boston had softened during the first nine months of 2025.

About 30 percent of condominiums listed in Boston between January 1, 2025, and September 30, 2025, had price drops, according to MLS Property Information Network, Inc., the local multiple listing service. During the same period in 2024, about 26 percent of properties had price drops, compared with about 23 percent during those nine months in 2023.